How to Withdraw Money from Shopify in 2026: Step-by-Step

Table Of Contents

Shopify, a leading e-commerce platform, offers users the ability to manage sales, inventory, and transactions through its built-in payment system, Shopify Payments. This feature simplifies the process of receiving payments from customers globally. However, understanding how to manage payouts and the available withdrawal options is crucial for store owners to handle their cash flow effectively.

In this blog, we'll cover everything you need to know about how to withdraw money from Shopify in 2026 step-by-step. This guide will walk you through the various withdrawal options and ensure you can access your earnings smoothly.

Understanding Shopify Balance and Account Types

Shopify Balance is more than just a payment processor; it's your all-in-one business wallet. When customers make purchases, the funds are automatically deposited into your Shopify Balance account. It acts like a secure digital vault, helping you manage your business finances easily. When you're ready, with a few clicks, you may withdraw money straight to the bank account you've linked.

Shopify offers different account types tailored to your business size and needs. Each type comes with specific transaction limits for sending and receiving funds. Whether you're a new seller or managing a high-volume business, Shopify Balance has a plan to suit you.

Here's a quick look at the transaction limits for each Shopify Balance account type:

|

Account Types |

Daily |

Weekly |

Monthly |

|||

|

Send limit |

Receive limit |

Send limit |

Receive limit |

Send limit |

Receive limit |

|

|

Shopify |

$50,000 |

$1,000,000 |

$100,000 |

$5,000,000 |

$500,000 |

$20,000,000 |

|

Shopify pro |

$100,000 |

$2,500,000 |

$250,000 |

$10,000,000 |

$1,000,000 |

$40,000,000 |

|

Shopify Enterprise |

$250,000 |

$5,000,000 |

$500,000 |

$20,000,000 |

$2,500,000 |

$80,000,000 |

Send limits

- The maximum amount of money you may transfer from your Shopify Balance account in a specific amount of time is known as the send limit.

- You may transfer funds to external payment processors, other Shopify Balance accounts, or your bank account.

Receive limits

- The maximum amount of money that may be deposited into your Shopify Balance account in a specific time frame is known as the receive limit.

- Customers, other Shopify Balance accounts, and other payment processors can all send you money.

Increasing your limits

You can get in touch with Shopify support if you need to raise your transaction limits. They can raise your limitations based on your company's size and risk profile.

Other considerations regarding transaction restrictions for Shopify Balance accounts are as follows:

- The limitations might change at any time.

- If Shopify believes your account is being used fraudulently, they may temporarily reduce your limitations.

- Both the Shopify Balance website and the Shopify Balance app allow you to see your current transaction limitations.

Fee and Charge when Withdraw Money from Shopify

Withdrawing money from your Shopify Balance account to your linked bank account is a breeze—and the best part? There are no withdrawal fees. This means you can transfer your earnings without worrying about extra charges eating into your profits. It's a straightforward process, making Shopify Balance an ideal option for business owners who want a hassle-free way to access their funds.

However, if you choose to withdraw your funds to another Shopify Balance account or an external payment processor like PayPal, be prepared for potential fees. For example, a 3% fee is usually assessed by PayPal when money is transferred to a bank account. While Shopify doesn't charge any fees for these types of withdrawals, third-party services may add their costs.

Another factor to consider is currency conversion. If you're withdrawing money in a different currency from your Shopify Balance account, there will be a currency conversion fee. The exchange rate determines this fee at the time of the transaction, which can fluctuate.

Depending on the currency, these fees can add up, so it's a good idea to monitor exchange rates. You can easily view the current conversion rates and any associated fees on the Shopify Balance website to ensure there are no surprises when transferring funds.

Step-by-Step Guide to Withdrawing Money from Shopify

The procedure of taking money out of your Shopify Balance account is easy and only requires a few quick steps. Whether you're looking to transfer funds to your bank account or an external payment processor, everything you need to know will be covered in this detailed tutorial. Let's get started!

Step 1: Log into Your Shopify Account

To get started, you'll first need to log into your Shopify account:

- Go to the Shopify login page.

- Enter your email address and password.

- Click "Log In" to go into your Shopify dashboard.

Step 2: Access Shopify Balance

Once logged in, the next step is to access your Shopify Balance account:

- On your Shopify dashboard, find and click on the "Settings" tab (usually at the bottom left).

- From the dropdown, select "Payments."

- Under Shopify Payments, click on "Payouts" to view and manage your balance for withdrawals.

Step 3: Review Available Balance

Before making any withdrawals, you'll want to ensure you have enough funds available:

- Under the "Payout Settings" section, you'll be able to see your current available balance.

- Double-check that your balance is sufficient to cover the amount you wish to withdraw.

- If everything looks good, you're ready to proceed!

Step 4: Choose the Payout Method

Now it's time to choose how you want to receive your money. Shopify offers various payout methods:

- Direct Bank Transfer: Link your bank account to Shopify for automatic transfers to your bank.

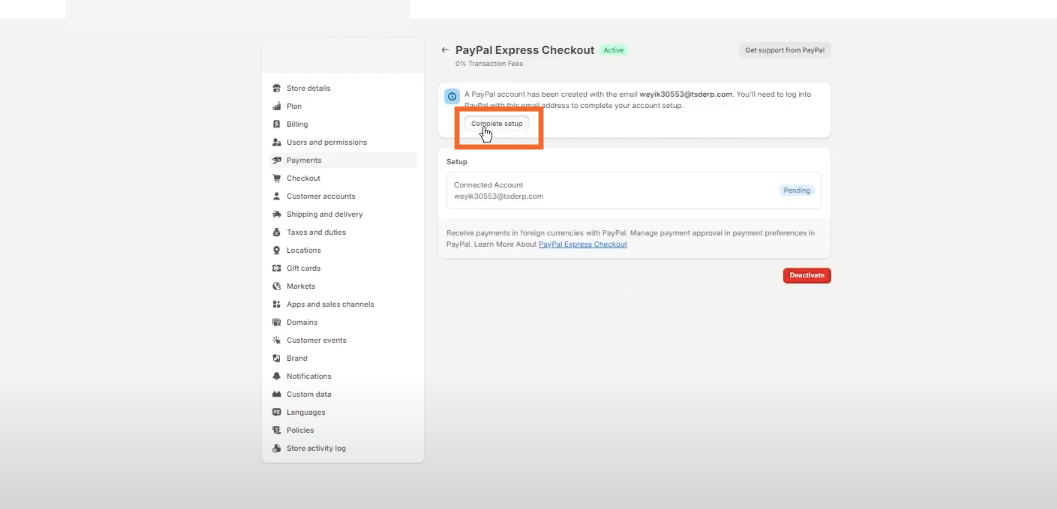

- PayPal: You can also withdraw funds to your PayPal account if that's more convenient.

- Other Payment Processors: Shopify supports several third-party payment processors, depending on your location.

- Click on "Manage payout methods" to select your preferred withdrawal method.

Step 5: Initiate the Withdrawal Request

Once you've set up your payout method, it's time to initiate the withdrawal:

- Click on the "Request payout" button.

- Enter the amount you wish to withdraw.

- Review the payout details and ensure that everything, including your chosen payout method, is accurate.

- Check the box if you agree to the terms and rules.

- Click "Confirm payout" to finalize the request.

Step 6: Track the Status of Your Withdrawal

After submitting your request, Shopify will send you a confirmation email notifying you that the withdrawal is being processed. The time it takes to complete the transaction will depend on the payout method:

- Bank transfers may take a few business days.

- PayPal and other methods may be quicker.

- You will receive a second email verifying the transfer of funds as soon as the withdrawal is completed. Check your bank account or PayPal to verify receipt of your funds.

Common Issues and Troubleshooting Tips for Withdrawals

Delayed Transfers and Payout Schedule

One of the most frequent issues with Shopify withdrawals is delayed transfers. Here's why it might happen and how to handle it:

- Typical payout schedule: Shopify usually processes payouts within 2-3 business days. However, weekends and public holidays can extend this time frame since Shopify only processes transactions on non-business days.

- Bank processing: Even after Shopify processes your payout, your bank may need additional time to clear the funds, especially for international transfers. One to five business days may pass during this time.

- What you can do: Always check the expected payout date in your Shopify dashboard and be aware of any upcoming holidays. Be prepared for a delay if the payment date comes on a weekend or public holiday. Shopify's Payouts feature allows you to monitor the status of your payout.

Updating Bank Details and Avoiding Errors

Sometimes, payouts fail due to errors in your bank account details. To prevent this, here's what you should do:

- Verify your bank information: Regularly check that your bank account details (account number, routing number, etc.) are correct within Shopify.

- How to update: Navigate to Settings > Payments and click on Manage Payout Methods. Ensure your bank details are up-to-date and correctly entered.

- Avoid errors: A simple typo can prevent your funds from being transferred. Double-check the details before saving. If the transfer fails, Shopify will notify you of the error and allow you to correct the information.

Exceeding Transaction Limits

Shopify imposes limits on the amount you can withdraw at a time, which could be a barrier if you're processing large withdrawals. Here's how to manage it:

- Transaction limits: Shopify has daily, weekly, and monthly transaction limits for each Shopify Balance account type. Exceeding these limits will ensure your withdrawal is processed.

- What you can do: If you need to withdraw more than the limit allows, you can either split your withdrawal into smaller amounts across multiple transactions or increase your limits by contacting Shopify support if your business qualifies.

Managing Currency Conversion and International Fees

If you're withdrawing money in a currency different from your local currency, you may encounter additional currency conversion fees. Here's how to manage them:

- Currency conversion fees: Shopify charges a fee for currency conversion when transferring funds to an account in a different currency. The exact fee depends on the exchange rate and your bank's policies.

- Tips to minimize fees: To avoid excessive currency conversion costs, try to link your Shopify Balance account to a multi-currency bank account or choose to withdraw in your local currency to eliminate the conversion fee. Always check the Shopify Balance website for current exchange rates.

Technical Issues During the Withdrawal Process

Technical glitches can sometimes disrupt the withdrawal process. Common issues include failed transactions or system outages. Here's how to troubleshoot:

- Failed transactions: If a transaction fails, Shopify will usually provide an error message explaining the issue (e.g., incorrect bank details or insufficient balance). Address the issue by correcting the error and attempting the withdrawal again.

- System outages: Sometimes, Shopify may experience system-wide issues or maintenance that can temporarily affect payouts. Check the Shopify status page for updates on any ongoing outages.

- Contact Shopify Support: If you've tried everything and the problem persists, don't hesitate to reach out to Shopify's support team. They can assist in identifying and fixing any technical problems that are impeding your withdrawal.

Best Practices for Smooth and Efficient Withdrawals

You may improve your money management, prevent delays, and reduce errors by following a few useful guidelines to guarantee a smooth and effective withdrawal process with Shopify. Here's how to make your withdrawal process smoother and more reliable:

Schedule Withdrawals to Avoid Last-Minute Delays

Set a regular withdrawal schedule: Instead of waiting until the last minute, plan to withdraw money on a regular basis, such as bi-weekly or monthly. This helps you stay in control of your cash flow and avoid last-minute rushes that might lead to mistakes.

Use reminders: Set up reminders on your calendar or in a task manager to ensure you don't forget your withdrawal dates. By taking one easy action, you may prevent delays and keep on top of your financial objectives.

Maintain Updated Bank Information

Review your bank details regularly: Even if you've already linked your bank account to Shopify, it's important to verify that your bank details are correct periodically. This will ensure your payouts are processed without any issues.

Update whenever there's a change: If you change banks or your account details change for any reason, update your information in Shopify Payments as soon as possible. This will prevent any hiccups in the withdrawal process.

Split Large Withdrawals When Necessary

Track your transaction limits: Shopify has set daily, weekly, and monthly transaction limits. You may prevent exceeding these restrictions, which can cause your withdrawal to be delayed, by keeping track of them.

Break large withdrawals into smaller amounts: If your withdrawal exceeds the limits, consider splitting it into multiple smaller transactions. For example, if you need to withdraw $700,000 but your monthly limit is $500,000, you can split it into two smaller withdrawals to stay within the cap.

Use Real-Time Tracking for Payout Status

Monitor payouts directly from your dashboard: Shopify allows you to track your payouts in real time, giving you visibility on the status of each withdrawal. This feature helps you stay informed about whether your payout is processing or if any issues arise.

Act quickly if something goes wrong: If you notice a delay or an issue with your payout, you can address it right away. Whether it's an issue with your bank information or a technical glitch, the sooner you take action, the less impact it will have on your cash flow.

FAQs

How Long Does a Shopify Payout Take?

Typically, Shopify payouts are processed within 2-3 business days. However, depending on the payment option you select and the processing timeframes of your bank, the actual time it takes for the money to arrive in your bank account may differ. Keep in mind that weekends and public holidays can cause additional delays, so it's always good to plan ahead to avoid any inconvenience.

Can I Change My Payout Method or Schedule?

Yes, you can easily change your payout method or schedule within your Shopify account. To update your payout method, go to the "Payments" section in the Shopify admin, and under "Payouts," select "Manage Payout Methods." You can switch between options like direct bank transfers, PayPal, or other third-party processors. Similarly, you can adjust your payout schedule to suit your business needs, such as opting for weekly, bi-weekly, or monthly withdrawals.

What Happens if a Payout Fails?

If a payout fails, Shopify will notify you via email and provide instructions on what went wrong. The most common reasons for payout failures include incorrect bank details, insufficient funds in your Shopify Balance, or bank-related issues. To resolve the issue, double-check your bank details, verify that your account is free of any holds or blocks, then attempt the transaction once more. If the issue persists, Shopify support can assist further.

Are There Fees for Withdrawing from Shopify?

There are no fees for withdrawing money directly from your Shopify Balance account to your bank account. However, depending on your payout method or if currency conversion is required, there may be associated fees. For instance, PayPal charges a small fee for withdrawals, and currency conversions can incur an additional cost based on exchange rates.

How do you contact Shopify Support for withdrawal issues?

If you encounter any issues during the withdrawal process, you can contact Shopify support through multiple channels. The easiest way is to visit the Shopify Help Center online, where you can access live chat, email support, or request a phone call. The Shopify support staff is on hand around-the-clock to help you with any withdrawal-related concerns. Additionally, you can find detailed troubleshooting guides on their help pages for quick solutions.

Conclusion

Maintaining your company's seamless operation and managing cash flow effectively require an understanding of Shopify's withdrawal procedure. Potential issues can be avoided, withdrawal methods can be managed, and payment processes may be understood to avoid unnecessary delays or inconveniences.

To streamline your operations, set up a reliable payout schedule—whether weekly, bi-weekly, or monthly.You can stay on top of your financial goals and ensure consistent access to your funds by doing this. You can make your Shopify withdrawals easy and hassle-free if you have a good plan in place.

0 comments