Does Shopify Collect Sales Tax? How To Set Up It?

Table Of Contents

Are you wondering if Shopify collects sales tax? Your answer you need in this blog. Ensuring accurate calculations and timely filings can be complex with constantly evolving tax laws. If you sell products as a US company owner, sales tax due dates might be a shock, particularly if you lack experience.

Don't worry-this tutorial will show you how to set up sales tax on Shopify. We'll cover everything from tax responsibilities to Shopify's tax settings.

What Is Sales Tax?

A sales tax is a tax that people pay when they buy things and use services. The customer pays it at the point of sale, the seller collects it, and the government receives it frequently, depending on the seller's volume, products, and state rules.

In 45 states and the District of Columbia, sales tax is collected at the state level. In some towns and cities, it is taken at the city level. Currently, Alaska, Delaware, Montana, New Hampshire, and Oregon are the only five states that don't collect sales tax at the state level.

Does Shopify Collect Sales Tax For Sellers?

No, Shopify does not send your taxes or pay them for you. Shopify is not a "marketplace facilitator" like Amazon or eBay. This means that the Shopify seller is in charge of sending sales tax to the states.

However, Shopify makes it easy to charge sales taxes automatically. There is a sales tax reference page on Shopify that can help you learn about the sales tax rates, collection rules, and connection circumstances for each state.

In this blog, we will help you determine where to charge taxes in the United States. You can set up your store once you understand where to charge taxes.

How To Set Up Sales Tax Collection In Shopify?

Here are the steps you need to take to set up your Shopify business to collect sales tax.

Step 1: Locate Your Nexus

Nexus is a legal term that determines whether a business has enough connection to a state to be required to collect and remit sales tax. Traditionally, a physical presence was necessary to establish a nexus.

However, because of the Supreme Court's seminal decision in South Dakota v. Wayfair, firms may now be forced to collect sales tax in states even if they don't have a physical presence, depending on the sales they generate there.

There are two primary Nexus types:

- Physical Nexus happens when a company has a warehouse, office, or employee in a state.

- Economic Nexus develops when a company meets a state-set sales threshold.

NOTE: Each state decides what an economic center is based on factors such as sales and transaction counts.

Step 2: Inform Shopify Where To Collect Sales Tax

Luckily, Shopify has a built-in tax calculator that can help you find possible nexus states based on the states where you make sales. To use this feature:

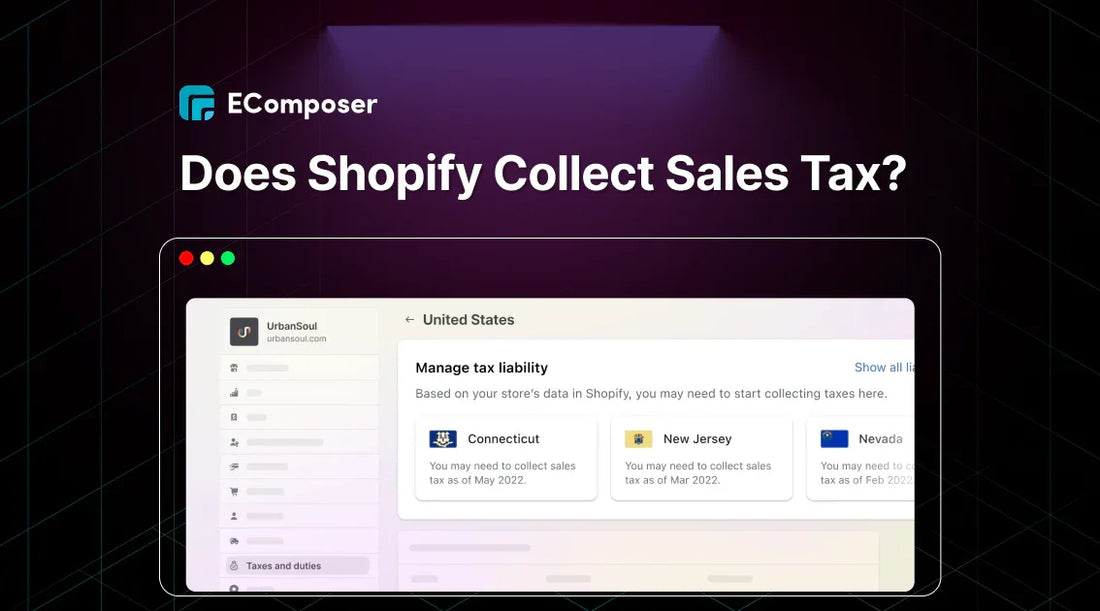

Firstly, navigate to your Shopify admin and Settings > Taxes and Duties.

Next, if you have sales in the United States or Canada, you'll see options to "Manage sales tax collection." You can visit Shopify's US and Canadian support articles for extra information on these decisions.

As shown in the image below, we will click on the "United States" section.

After clicking, you will see three Shopify seller choices:

- Manage tax collection lets you track sales statistics, transactions, and state thresholds for states mentioned under any of these three sections. If you meet both criteria, you'll be asked to act for the state.

- The tax rates and exemptions option lets you categorize all your products like Amazon. Since products are taxed differently, you may arrange them so that Shopify can automatically divide the proper tax.

- The reporting feature lets you submit sales tax and obtain all the necessary information. You can also easily export reports and examine county breakdowns.

After getting used to the new data in the three options above. Scroll down and click on "Collect Sales Tax," as shown below:

Then, use the dropdown menu to select places where you should collect taxes because you have a business or real presence.

Before entering your sales tax ID on this screen, have it handy. You can use your federal employment identification number (FEIN) if you don't have that number yet.

Step 3: Sort Products Into Groups For Tax Purposes

After step 3, scroll down to find the "Categorize Products for Tax Purposes" part. Then, you click the "Manage Categories" option.

Shopify's tax settings depend on correctly categorizing products. You can speed up the tax calculation process by placing goods in the right tax-exempt or taxable areas.

If you've accurately defined the regions where you collect taxes, Shopify will automatically exempt products in designated categories from taxation in specific areas.

For example, if you've set Pennsylvania as a tax region and categorized clothing products accordingly, clothing items will be automatically tax-exempt in Pennsylvania.

You can create manual overrides if a product doesn't fit into a predefined category or requires a specific tax rate. This allows you to assign custom tax rates to individual products or collections.

Step 4: Add Sales Tax Shipping Options

Shipping and sales tax collection are mostly built into Shopify. So, in the "Shipping overrides" areas, sales tax will be added automatically to shipping.

If that isn't the case, shipping charges can be used if needed. To do so, click the "Add shipping override" option.

Step 5: Set Up Which Products Need Sales Tax

Once you've established which states to collect sales tax from, the next step is identifying which products are taxable.

Not all products are subject to sales tax. For example, digital products like ebooks or software are often exempt, while physical goods typically are not. Additionally, some states have specific exemptions for certain product categories, such as clothing below a specific price point.

Here's how to set this up:

- Go to your Shopify admin and select "Products."

- Next, click on a product to edit its details. You'll see a checkbox labeled "Charge tax on this product" for each variant.

- Check this box for taxable products and uncheck it for tax-exempt items.

For easier management, you can create product categories based on taxability and assign products accordingly.

Step 6: Add Warehouse Locations

Shopify needs to know where your products are shipped to calculate sales tax correctly. This is because tax rates can vary based on the shipment's origin.

You can go to Settings in your Shopify admin > Select Locations.

Finally, you can add your warehouse addresses.

By providing correct warehouse information, you ensure that your customers pay the right sales tax amount and that shipping costs are figured correctly.

Step 7: Add Sales Tax Exempt Customers

Sales tax isn't charged to all buyers. Tax breaks are often available to dealers, government agencies, and charities, among other groups.

To manage tax-exempt customers on Shopify, go to the "Customers" option and create a new profile for each tax-exempt customer.

When creating the customer profile, uncheck the "Collect tax" box and provide a reason for the exemption (e.g., "Tax-exempt certificate on file").

NOTE: Always verify the validity of tax-exempt certificates to prevent potential legal issues.

How To Prepare Your Shopify Sales Tax Reports?

In this part, we will guide you through generating and analyzing Shopify sales tax reports.

Calculate Shopify Sales Tax For Different States

When it's time to file your sales tax, you should add how much you've gotten from customers in all the states where you do business.

Here is the sales tax calculation:

|

Sales tax is calculated as a percentage of the product's price. |

For example, if a product costs $20 and the sales tax rate is 7%, the sales tax would be $1.40.

Read more: Top 11 Shopify Accounting Apps for Your Store.

But don't worry, Shopping Tax's new sales tax report has everything you need to prepare to file sales tax. This new report gives you both net and taxed sales, breaks them down by state, county, and local level, and gives you the exact reporting code.

Each state has its own rules about how much information must be reported. Most states want to know how much sales tax you earn from people who live in their state, broken down by county, city, or district.

In the "Manage tax collection" option. You will see that Shopify classifies locales into three categories:

- The action required option is you likely owe sales tax in these locations.

- Monitoring the required option if you're approaching the sales threshold for potential tax obligations.

- No action required option is tour sales in these locations don't trigger tax responsibilities.

For example, in our image below, this business has made $20,362 in sales to customers in New York. New York State's economic nexus threshold is $500,000 in sales or 200 transactions within 12 months.

In this case, the business exceeded the $100 order threshold but did not reach the $500,000 sales threshold, so it has no economic nexus in New York State now.

That means a business should meet sales volume and transaction count requirements to establish an economic nexus in New York.

File Your Sales Tax Returns

Once you've collected sales tax from your customers, remitting the funds to the appropriate tax authorities is the next crucial step.

For report and remit:

You should complete a sales tax report for every state where you collected sales tax. Different states have different filing times, but most do it once a month, three times a year, or once a year.

For zero returns:

Even if you haven't collected any sales tax in a particular period, you may still need to file a "zero return" to maintain compliance.

You may have to pay fines and interest if you miss a sales tax date. So, write down when the sales tax is due. Some notifications will let you know when and where to file your taxes if you use Shopify Tax.

What Happens If You Don't Collect Sales Tax On Shopify?

If you do not collect sales tax on Shopify, you might be required to pay it out of pocket when it comes time to submit taxes. You might lose money, especially if you sell many goods.

Also, customers may lose trust in your business if they discover you do not charge sales tax when required.

FAQs

Can I Manage Shopify Sales Tax With A Third-Party App?

Yes, you can use third-party apps to manage sales tax on your Shopify store. Many businesses opt for these solutions due to their specialized features and ability to handle complex tax calculations.

Read more: Top 10 Free and paid Shopify Tax Apps.

Does Shopify Charge Sales Tax On Shipping?

Shopify itself doesn't determine whether or not to charge sales tax on shipping. The decision to charge sales tax on shipping is governed by the specific tax laws of the jurisdiction where the sale is made.

What Is The Difference Between Sales Tax And VAT On Shopify?

Sales Tax and Value Added Tax (VAT) are both consumption taxes levied on selling goods and services, but they operate differently.

|

Sales Tax |

VAT |

|

|

Application |

Point of sale. |

Each stage of production. |

|

Tax burden |

Final consumer. |

Distributed throughout the supply chain. |

|

Common regions |

North America. |

Europe, Asia, Africa. |

|

Administrative complexity |

Lower. |

Higher. |

Key Takeaway

If you understand our blog's ideas about linking, tax areas, and product labeling, you can set up your store to make sales tax. Shopify store owners must correctly figure out and collect sales tax to stay in line and avoid fines.

Sales tax rules can be hard to understand, and they can change at any time. If you want to know about new Shopify features, subscribe to our blog.

0 comments