How To Accept Shopify Split Payments? (In-Person & Online)

Table Of Contents

Shopify split payments are fast-changing the e-commerce environment. According to the Oney Group, six out of ten customers in France, Spain, Poland, and Portugal use split payments. Businesses may maximize sales, while customers can easily handle larger purchases.

But how can you activate this functionality on Shopify? This thorough tutorial will show you all you need to know about getting Shopify split payments in person and online.

What Is Split Payment In Shopify?

Shopify split payments let customers break up their purchases into smaller pieces, which makes them more affordable and helps sellers make more sales. This flexibility allows merchants to combine credit cards and cash or install installment plans.

Simply put, a split payment is when you use more than one way of payment to cover the cost of a single order of products or services.

Shopify split payments shine in physical businesses. This may reduce abandoned carts since customers are more likely to complete their purchases with this simple option.

2 Ways To Accept Your First Split Payment On Shopify Store

Now that you've learned about the advantages and choices of Shopify split payments, let's get into the details. We'll look at two techniques for receiving split payments:

Option 1: Using Shopify POS (In-Person Sales)

Shopify POS enables you to accept partial payments, making it more straightforward for customers to buy your items even if they cannot pay the entire amount upfront.

Here's a quick tutorial on taking partial payments:

Step 1: Log into your Shopify admin. To access your Shopify account, enter your email address and password.

Step 2: Locate the order. Navigate to the "Orders" area and identify the order you wish to accept a split payment.

Step 3: Select the "Take payment" option on the order details page.

Step 4: On the Split Payments page, choose "Add payment". This signifies that you accept a partial payment.

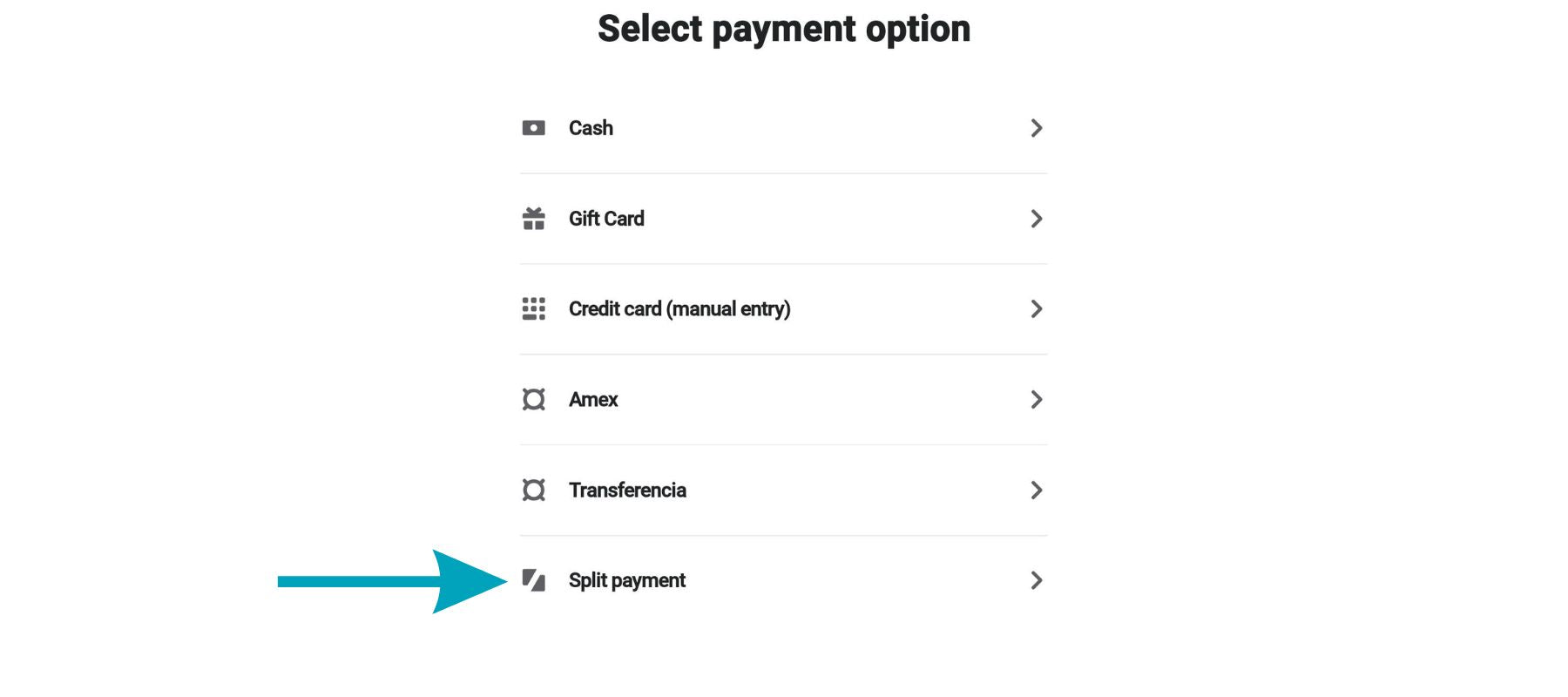

Step 5: In the Select payment method window, select Split payment.

Step 6: For the first payment, enter the customer's payment amount. Ask your consumer to choose the amount they wish to pay today.

Step 7: Now, allow your customers to choose their payment method (credit card, debit card, etc.).

Step 8: Complete the spilled payment by clicking "Accept" or "Charge" after verifying the amount and then finish the payment by selecting “Mark as paid.”

Step 9: For the next payment, enter the amount that the customer is paying.

Step 9: Tap the following payment option and then finish the transaction as in step seven above.

That is it! The half payment is complete and will be shown in the order details. Your consumer may return to pay the remaining payment at a later date.

NOTE:

- Repeat steps 4–7 to take several split payments from the same consumer.

- Consider providing explicit notification to your consumer about the remaining amount, such as sending a reminder email.

Option 2: Using Third-Party Apps (For Online Store)

You may accept multiple and partial payments when processing in-person orders using the Shopify POS. But if you want to handle split payments for online sales, you'd need to use a third-party app.

Third-party applications provide additional ways to tailor the split payment experience. You may choose the minimum and maximum payment amounts, provide incentives for early payments, and manage group contributions.

We will install and navigate the Deposit & Split Payment Depo app in this example.

Step 1: Open the Shopify App Store and install the Deposit & Split Payment Depo app.

Step 2: After entering the Shopify admin dashboard, choose "Deposit & Split Payment Depo" from the Apps option on the left menu.

Step 3: Now deposit and split the payment. Depo will show you how to construct a draft split payments order in five stages. Let's follow it.

3 Best Shopify Split Payments Apps

Using the right payment platforms and apps makes this feature part of the buying process. In this part, we'll look at some of the best payment-dividing apps.

#1. Shop Pay Installments

Shop Pay Installments’s homepage.

Shop Pay Installments is a feature of Shop Pay, Shopify's rapid checkout option. It's only accessible to shops that use Shopify payments.

You can pay your customer in installments if you are eligible for Shop Pay Installments.

|

Feature |

Description |

|

Split Payments |

Customers may pay in 4 interest-free payments. |

|

Faster Checkouts |

Shop Pay keeps payment and shipping information. |

|

Convenience |

Available for both online and in-store purchases. |

|

Seamless Integration |

Native Shopify solution. |

|

Eligibility |

Requires Shopify Payments. |

|

Order Minimum |

$50 |

|

Order Maximum |

$999.99 |

Key Points:

- Available only via Shopify Payments.

- Interest-free payments are available for purchases ranging from $50 to $999.99.

- Returning customers benefit from a faster checkout experience.

- Valid for both online and in-store purchases. Integrates easily with the Shopify ecosystem.

#2. Deposit & Split Payment Depo

Deposit & Split Payment Depo allows you to handle partial or split payments, pre-orders, and deposits for online and draft orders.

|

Feature |

Description |

|

Split Payments |

Divide the order total into Multiple installments. |

|

Pre-Orders |

Secure purchases for upcoming items. |

|

Deposits |

Pay some immediately and the rest later. |

|

Draft Order Deposits |

Take deposits on draft orders created in the Shopify admin. |

|

Automatic Charges |

The remaining deposit amount is charged automatically. |

|

Subscriptions |

Create regular payments for items or services. |

|

Automated Invoices |

Send invoices automatically from the Depo dashboard. |

Rating: 4.7/5 stars of over 79 votes.

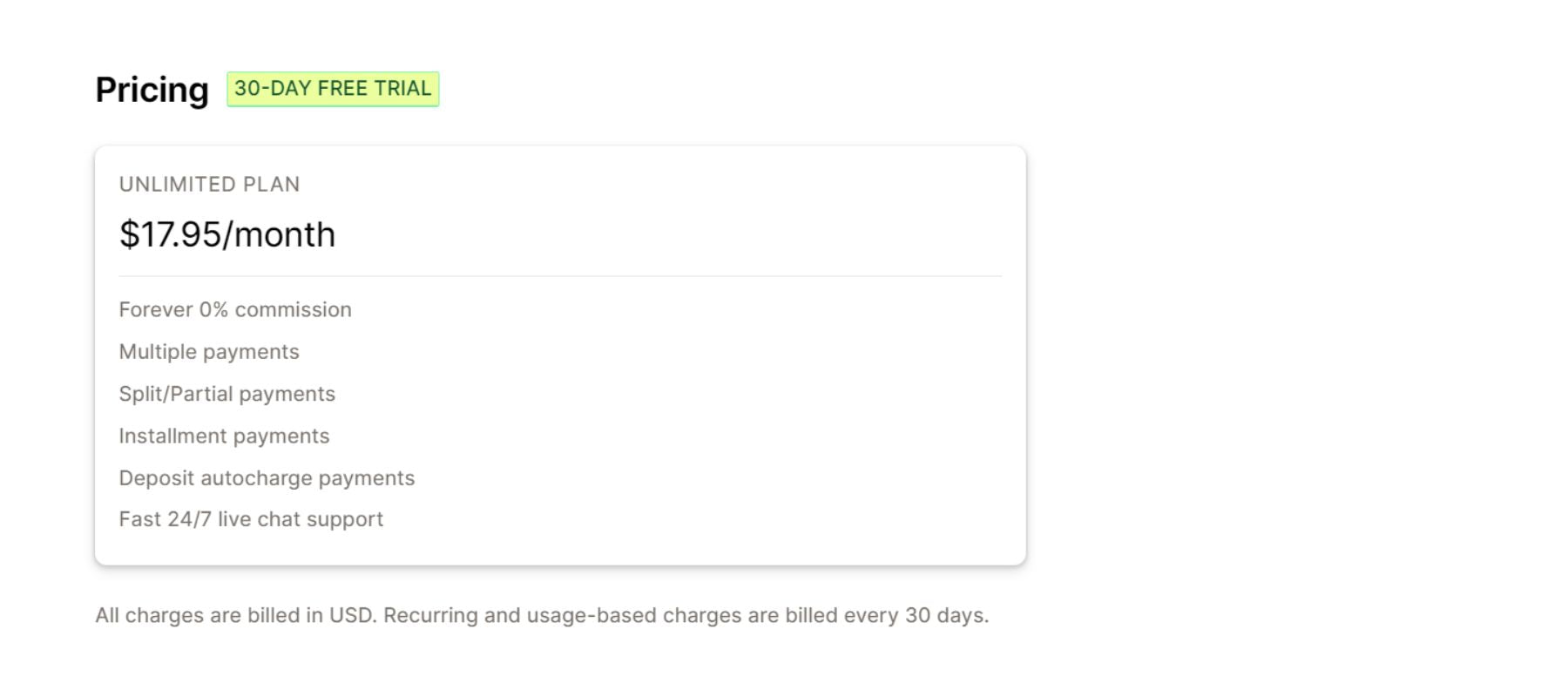

Pricing: There is a free trial, and packages range from a dollar package of $1/ month to a Pro package of $75/month.

Deposit & Split Payment Depo’s pricing.

#3. Split Payment & Deposit SpurIT

Split Payment & Deposit SpurIT on the Shopify App Store

Split Payment and Deposit SpurIT is a unique app that provides your company with a four-in-one payment solution:

|

Feature |

Description |

|

Split Payments |

Use different payment methods (credit cards, PayPal) in a single transaction. |

|

Deposits |

Make a deposit and pay the remaining balance later. |

|

Installments |

Divide payments into smaller and equal installments. |

|

Shareable Payments |

Allow numerous individuals to contribute to one purchase. |

Rating: 4.4/5 stars of over 70 votes.

Pricing: $17.95/month with a 30-day free trial.

Split Payment & Deposit SpurIT's pricing.

Common Problems & Solutions When Split Payments On Shopify

Shopify lets you split payments, which can be a great way to give your customers more options and make more sales. But sometimes there are unexpected problems. Let's look at some common issues you might have and how to solve them in a way that puts your customer first.

Have To Split Payments Into Two Credit Cards In An Online Store

Let's assume this: A couple happily fills their online cart with the ideal anniversary present. Since the transaction is significant, they want to split it into two credit cards. But now, your Shopify stores don't use third-party split payment.

Here's how to turn this situation around:

First, use Shopify's Draft Order functionality to create two distinct draft orders, each representing half of the total cost.

Write clearly in the order notes, using this situation as an example: "Payment for Anniversary Gift—Split 1/2" and "Payment for Anniversary Gift—Split 2/2."

Then, contact the consumer and explain your solution. Also, provide explicit directions for completing each draft order payment.

Taking these actions transforms a possible lost transaction into an excellent customer experience. They will appreciate your flexibility and be more inclined to return for future purchases.

Pro tips:

- While draft orders are a solution, think about using third-party split payment programs for a more simplified experience in the future.

- Your customer service reps should know how to properly handle calls for split payments and explain their choices.

Confusion Around Partial Vs. Split Payments

For example, a customer might approach you in the store and want to pay for a more significant item with cash and a credit card. They might not know if your store lets people make "partial payments" or "split payments."

Solutions are good communication and staff training.

First, briefly describe the difference between split payments (multiple methods) and partial payments (single customer, various installments).

Read more: A Comprehensive Guide for Shopify Partial Payments.

Also, make sure your team is familiar with discussing these payment methods with consumers and can walk them through the procedure.

You can consider placing signs at checkout areas explaining different payment methods, such as split payments (if applicable) and partial payments.

Pro tips: Struggling to explain your payment options at checkout? This is where the EComposer Page Builder comes in. This #1 Shopify builder page is the hidden weapon for checkout signage:

- Drag-and-drop is simple, with no coding.

- 100+ pre-built templates and 260+ section layouts.

- Mobile responsiveness.

Furthermore, EComposer allows you to create any page type or area on your Shopify shop, including checkout pages, landing pages, product pages, blog entries, and more.

Ready to improve your Shopify shop with clear payment choices signage? Try EComposer for free now.

Read more:

FAQs

1. What Are The Security Considerations When Using Split Payments?

Here are some essential things to keep in mind:

- One-time-use cards: A fraudster may use a stolen virtual card for part of the payment, making it difficult to check and recover the money.

- Chargebacks: One payer may start a chargeback on their payment, leaving the firm responsible for the remaining amount.

- Data Security: Split payments may need customer email addresses. This data must be securely maintained by applicable data privacy legislation.

- Third-party apps: If you use third-party software to handle split payments, be sure it has an established track record and meets industry security requirements.

- Compliance: Regulations such as PCI DSS (Payment Card Industry Data Security Standard) govern the storage and transmission of cardholder data. Ensure that your split payment method is compliant.

Understanding these security factors and adopting suitable precautions allows you to more confidently provide split payments to your clients, reducing the chance of fraud and safeguarding your organization.

2. Are There Any Fees Associated With Using Split Payments On Shopify?

Yes, there are two significant methods to offer split payments on Shopify, each with its own price structure.

For Shopify POS: There are no extra costs when utilizing Shopify POS payments. However, you will still be charged the regular transaction costs associated with your selected payment method (credit card processing fees, etc.).

For third-party split payment apps, extra fees are often charged in addition to the normal Shopify transaction costs. The pricing structure varies according to the app and the exact services utilized.

3. What Do I Do If There's A Dispute Or Chargeback On A Split Payment?

When a dispute or chargeback emerges on a split payment transaction, the situation might become more complicated than with a conventional buy. Split payments might include many payers, making dispute resolution more difficult.

- You should recover the disputed amount from the specific payer who initiated the chargeback.

- Consider outlining a clear policy in your terms and conditions regarding handling disputes arising from split payments.

Resolving the dispute:

Step 1: Contact the consumer and ask the consumer about the disagreement.

Step 2: Investigate and Respond; use the information to investigate and dispute the chargeback.

Step 3: Working with the payment processor, use the payment processor's dispute resolution mechanism.

Understanding the various obstacles and applying these techniques can help you better handle disputes and chargebacks on split payments, reducing financial losses and safeguarding your organization.

You can discover more about Shopify's chargeback handling in this blog.

Final Thoughts

This blog article delves further into accepting Shopify split payments in person and online. Allowing customers to split payments may revolutionize your Shopify business. This simple payment option can help you attract new clients, raise average order value (AOV), and improve customer happiness.

Whether you use Shopify POS for in-person or third-party split payment tools for various online features, remember to emphasize security and transparent communication with your clients.

With the EComposer Builder Page, you can create conversion-optimized attractive sites that explain split payment choices, highlight items, and direct clients through the purchase process to boost consumer experience.

Learn more about Shopify at our blog.

0 comments