11+ Best Shopify Invoice Generators FREE for your business

Table Of Contents

Manual invoice creation is time-consuming and prone to errors affecting cash flow and customer satisfaction. Enter Shopify invoice generators - powerful tools designed to automate and simplify invoicing. In this blog, we’ll explore the best Shopify invoice generators that can help you streamline your business operations, enhance accuracy, and save valuable time. Whether you're a seasoned merchant or just starting, these tools will revolutionize how you handle invoices so you can focus on growing your business.

About Shopify Invoice Generator

A Shopify Invoice Generator is a specialized tool or app designed to automate creating and managing invoices for Shopify merchants. It integrates seamlessly with your Shopify store to streamline the invoicing process.

Key features of a Shopify Invoice Generator

- Automated Invoice Creation: The generator automatically creates invoices for each sale or order, reducing the need for manual data entry and minimizing errors.

- Customizable Templates: You can customize invoice templates to align with your brand’s look and feel, ensuring every invoice reflects your company's identity.

- Multi-Currency Support: These generators often support multiple currencies, which is crucial for international sales and accurate billing.

- Tax Calculations: They automatically calculate taxes based on your location and the customer's location, ensuring compliance with local tax regulations.

- Email Delivery: Invoices can be sent directly to customers via email, improving convenience and speed.

- Integration with Accounting Software: Many invoice generators integrate with popular accounting tools, simplifying financial management and record-keeping.

Benefits of using Shopify Invoice Generator

Using a Shopify Invoice Generator offers several key benefits that can significantly enhance the efficiency and professionalism of your eCommerce business:

- Time Savings: Automate the creation of invoices, freeing up valuable time that you can spend on other important tasks. There is no more manual data entry or repetitive invoicing processes.

- Error Reduction: Minimize human errors in invoicing, leading to more accurate billing and fewer customer disputes.

- Professional Appearance: Customizable templates allow you to create polished, branded invoices that reflect your business’s professionalism and improve customer perception.

- Efficient Record-Keeping: Simplify financial management by maintaining organized and easily accessible records of all transactions, which is crucial for audits and accounting.

- Enhance Customer Experience: Provide a seamless and prompt invoicing experience for customers, which can boost satisfaction and foster positive relationships.

- Multi-Currency and Tax Support: Automatically handle multi-currency transactions and tax calculations based on your business’s and customers’ locations, ensuring compliance with various tax regulations.

- Automated Follow-Ups: Send automated reminders for overdue invoices, which will help you maintain steady cash flow and reduce the need for manual follow-ups.

- Integration with Accounting Software: Many invoice generators integrate with popular accounting tools, streamlining your financial management and reducing the need for double entry.

- Improve Cash Flow: Ensuring timely and accurate invoicing can accelerate the payment process and improve your business’s cash flow.

- Scalability: As your business grows, an invoice generator can easily handle an increasing volume of invoices without additional resources.

A Shopify Invoice Generator helps streamline your invoicing process, making it more efficient, accurate, and professional. This ultimately contributes to smoother business operations and enhanced customer satisfaction.

Read more:

- How to Create an Invoice on Shopify

- How to Send an Invoice on Shopify

- 13+ Top Picks Shopify Invoice Apps

Best Shopify Invoice generators for your business

1. Shopify Invoice Generator

Shopify's built-in invoice generator provides a straightforward and integrated solution for managing invoices directly from your Shopify store. It simplifies invoicing by allowing you to create, customize, and manage invoices without needing third-party apps. Ideal for merchants who prefer an all-in-one solution, Shopify's tool ensures that invoicing is seamlessly integrated with your store's order management.

Key Features

- Automated invoice generation

- Basic customizable templates

- Integration with Shopify’s order management system

- Multi-currency and tax support

- Simple setup and use

2. Sufio

Sufio is an advanced invoicing tool designed specifically for Shopify merchants seeking a professional and efficient invoicing solution. It automates the creation of invoices, ensuring accuracy and compliance while saving time. With customizable templates and robust multi-currency and tax management features, Sufio helps businesses present a polished image and streamline their billing processes.

Key Features

- Automated invoice creation

- Customizable templates

- Multi-currency support

- Tax calculations and compliance

- Integration with accounting software

3. Invoice Falcon

Invoice Falcon offers a user-friendly invoicing solution tailored for Shopify store owners. Its intuitive interface and advanced features simplify the invoicing process, making managing and customizing invoices easier. Ideal for businesses that require multi-currency and tax support, Invoice Falcon helps automate billing tasks and enhance operational efficiency.

Key Features

- Customizable invoice templates

- Automated invoice generation

- Multi-currency and tax support

- Email delivery of invoices

- Integration with popular accounting tools

4. Order Printer Pro

Order Printer Pro is designed for Shopify merchants needing a versatile solution for generating and managing invoices and packing slips. It provides customizable templates and bulk printing options, making it easy to handle high volumes of orders efficiently. This tool ensures that all your invoicing and packing needs are met professionally and efficiently.

Key Features

- Customizable templates for invoices and packing slips

- Automated invoice generation

- Bulk printing and emailing options

- Integration with Shopify's order management

- Multi-language support

5. QuickBooks Online

QuickBooks Online integrates seamlessly with Shopify, offering a comprehensive invoicing and accounting solution. It combines automated invoice creation with advanced accounting features, helping merchants manage multi-currency transactions and ensure tax compliance. With its automated reminders and detailed reporting, QuickBooks Online simplifies financial management and improves cash flow.

Key Features:

- Automated invoice creation

- Customizable templates

- Integration with QuickBooks accounting software

- Multi-currency and tax management

- Automated invoice reminders

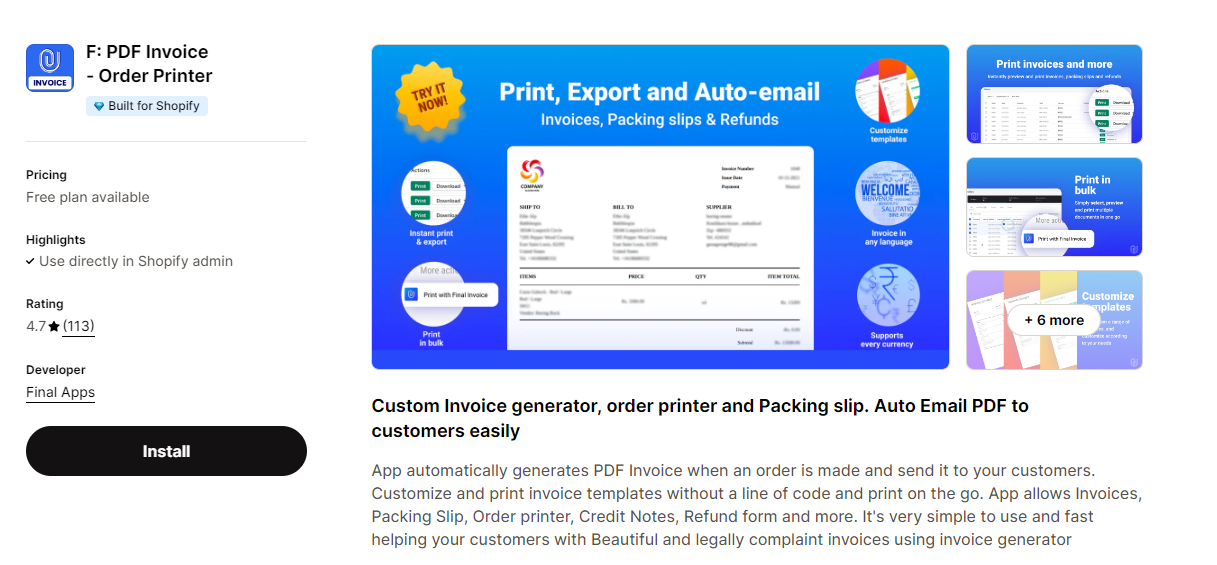

6. PDF Invoice & Order Printer

PDF Invoice & Order Printer provides a straightforward solution for generating and managing PDF invoices directly from Shopify. It offers easy customization and efficient email delivery, making it an excellent choice for merchants who prefer a simple yet effective invoicing tool. Its seamless setup ensures a smooth invoicing experience.

Key Features:

- PDF invoice generation

- Customizable templates

- Email invoices directly to customers

- Bulk printing options

- Simple setup and integration

7. Faktura

Faktura simplifies your invoicing process with its intuitive features and seamless Shopify integration. Offering customizable templates, automated invoice generation, and multi-currency support, Faktura caters to businesses of all sizes. It ensures accurate tax compliance and integrates with popular accounting software for streamlined financial management. Whether you're managing local or international transactions, Faktura helps make invoicing efficient and professional.

Key Features:

- Customizable Templates: Allows businesses to design invoices that match their branding.

- Automated Invoicing: Automates the creation and sending of invoices based on orders.

- Multi-Currency Support: Handles transactions in multiple currencies, making it suitable for international sales.

- Tax Compliance: Ensures invoices meet local tax regulations.

- Integration with Accounting Tools: Connects with various accounting software for streamlined financial management.

8. Xero Invoice Generator

Xero’s Invoice Generator integrates with Shopify to provide a robust invoicing solution that is combined with Xero’s accounting capabilities. It allows customized invoices, handles multi-currency transactions, and ensures accurate tax calculations. Xero’s comprehensive features also include automated reminders to help manage accounts receivable and maintain financial organization.

Key Features:

- Automated invoice creation

- Customizable templates

- Integration with Xero accounting software

- Multi-currency and tax support

- Automated invoice reminders

9. Invoicely

Invoicely offers an intuitive invoicing solution for Shopify merchants looking for simplicity and effectiveness. It automates the creation of invoices and provides customizable templates to maintain a professional appearance. Invoicely supports multiple currencies and integrates with various payment gateways, making it a versatile tool for efficient billing management.

Key Features:

- Automated invoice generation

- Customizable invoice templates

- Multi-currency support

- Integration with various payment gateways

- Reporting and analytics tools

10. Zoho Invoice

Zoho Invoice integrates with Shopify to deliver a comprehensive invoicing solution with extensive customization and automation features. It supports multi-currency transactions and ensures tax compliance while offering automated reminders and follow-ups. Zoho Invoice provides valuable insights into your financial operations, helping you optimize your billing process.

Key Features:

- Automated invoice creation

- Customizable templates

- Multi-currency and tax support

- Integration with Zoho’s suite of business tools

- Automated payment reminders and follow-ups

11. Bill.com

Bill.com combines invoicing with advanced payment and accounting features, making it an all-in-one solution for Shopify merchants. It automates invoice creation, processes payments, and integrates with major accounting software. Bill.com’s multi-currency support and automated reminders help maintain a steady cash flow and streamline financial operations.

Key Features:

- Automated invoice creation and payment

- Customizable templates

- Multi-currency support

- Integration with major accounting software

- Automated payment reminders and tracking

These tools offer a range of features to help you optimize your invoicing process, ensuring accuracy and efficiency for your Shopify store.

How to choose the right Shopify Invoice Generator

Choosing the right Shopify invoice generator involves several key considerations to ensure it meets your business needs effectively. Here’s a guide to help you make an informed decision:

Evaluate Your Invoicing Needs

- Invoice Volume: Consider the number of invoices you generate regularly. If you handle a high volume, look for tools that support bulk processing and automation.

- Customization Requirements: Determine how much customization you need for your invoices. Some tools offer extensive template customization, while others provide basic options.

Check Integration Capabilities

- Shopify Integration: Ensure the invoice generator integrates smoothly with Shopify for seamless order management and generation.

- Accounting Software: If you use accounting software like QuickBooks or Xero, check if the invoice generator integrates with it for streamlined financial management.

Consider Multi-Currency and Tax Support

- Multi-Currency Transactions: Choose a tool that supports multiple currencies and can handle different exchange rates for international sales.

- Tax Compliance: Ensure the tool automatically calculates taxes based on your location and the customer’s location to ensure compliance with local regulations.

Assess Ease of Use

- User Interface: Look for a tool with an intuitive, user-friendly interface that makes invoice creation and management straightforward.

- Setup and Support: Consider the ease of setting up the tool and the availability of customer support if you encounter issues.

Evaluate Customization Options

- Template Customization: Choose a tool to customize invoice templates to match your branding and business needs.

- Automated Features: Look for automated invoice generation, recurring invoices, and reminders to save time and reduce manual effort.

Review Pricing and Plans

- Cost: Compare the pricing of different tools and consider whether they offer value for money based on your invoicing needs.

- Free Trials: Take advantage of free trials or demos to test the tool’s features and compatibility with your business processes before committing.

Check for Reporting and Analytics

- Reporting Features: Some tools offer reporting and analytics to track invoicing performance, manage accounts receivable, and gain insights into your business finances.

- Analytics Tools: Assess whether the tool provides valuable data and metrics to help you optimize your invoicing and financial management.

Review Security and Compliance

- Data Security: Ensure the tool complies with security standards to protect your financial data and customer information.

- Compliance: Verify that the tool meets any legal requirements related to invoicing and financial transactions in your region.

Look for Customer Reviews and Recommendations

- User Feedback: Research customer reviews and testimonials to gauge the reliability and effectiveness of the tool.

- Recommendations: Seek recommendations from other Shopify merchants or industry experts to find reputable and trusted invoice generators.

Consider Future Growth

- Scalability: Choose a tool that can grow with your business, accommodating increased invoicing volume and additional features as your needs evolve.

- Flexibility: Ensure the tool can adapt to business process changes or expand into new markets.

By carefully evaluating these factors, you can select a Shopify invoice generator that aligns with your business requirements, enhances efficiency, and supports your financial management goals.

Tips for Optimizing Your Invoicing Process

Customize Invoice Templates

- Professional Design: Create and use branded invoice templates that reflect your company’s identity. Include your logo, business information, and a straightforward layout.

- Standardize Information: To avoid confusion, ensure all necessary details are included, such as payment terms, due dates, and itemized charges.

Implement E-Invoicing

- Digital Invoices: Send invoices electronically to speed delivery and reduce paper waste. This also allows for easier tracking and faster processing.

- Invoice Tracking: Use tools that offer tracking features to confirm when your clients receive and open invoices.

Integrate with Accounting Software

- Seamless Integration: Connect your invoicing tool with accounting software to streamline financial management, reduce manual data entry, and ensure accuracy in your financial records.

- Automate Reconciliation: Use integration to automatically reconcile invoices with payments, making your accounting process more efficient.

Utilize Payment Options

- Offer Multiple Payment Methods: To facilitate clients' payments, provide various payment options, such as credit cards, bank transfers, and digital wallets.

- Include Payment Links: Incorporate direct payment links or buttons in your invoices to simplify customers' payment processes.

Set Clear Payment Terms

- Define Terms: Clearly state payment terms on your invoices, including due dates, late fees, and discounts for early payment.

- Communicate Expectations: Ensure clients understand the payment terms upfront to reduce the likelihood of late payments.

Send Reminders and Follow-ups

- Automated Reminders: Use invoicing tools to send automated payment reminders and follow-ups as the due date approaches or if payment is overdue.

- Polite Communication: Send courteous reminders to maintain good customer relationships while encouraging timely payment.

Maintain Accurate Records

- Track Invoices: Keep a detailed record of all issued invoices, including payment statuses and any follow-up actions taken.

- Regular Audits: Periodically review your invoicing and payment records to identify any discrepancies or areas for improvement.

Analyze and Optimize

- Monitor Performance: Use reporting and analytics features to track invoicing performance, payment trends, and overdue invoices.

- Identify Trends: Analyze data to identify patterns or issues in your invoicing process and make adjustments to improve efficiency and effectiveness.

Ensure Compliance

- Legal Requirements: Stay updated on any legal or tax requirements related to invoicing in your region and ensure your invoices meet these standards.

- Data Security: Protect sensitive financial information by using secure invoicing tools and adhering to best practices for data security.

Implementing these tips can streamline your invoicing process, improve cash flow, and enhance your business's overall financial management.

Common Issues and Troubleshooting

Invoice Not Delivered

Issue: The invoice needs to reach the recipient, causing payment delays. Troubleshooting:

- Check Email Deliverability: Ensure the invoice email isn’t landing in the recipient's spam or junk folder.

- Verify Email Address: Double-check the recipient’s email address for any errors.

- Use Tracking Tools: Utilize invoicing tools with email tracking features to confirm delivery.

Incorrect Invoice Details

Issue: Errors in invoice details such as wrong amounts, item descriptions, or tax calculations. Troubleshooting:

- Review Templates: Ensure invoice templates are correctly set up with accurate formulas and placeholders.

- Manual Checks: Double-check the invoice details before sending to catch any manual errors.

- Update Software: Ensure your invoicing software is updated to fix any calculations-related bugs.

Payment Delays

Issue: Payments are delayed, affecting cash flow. Troubleshooting:

- Send Reminders: Use automated reminders and follow-ups to prompt clients to pay on time.

- Review Payment Terms: Clearly define payment terms on your invoices and ensure clients know them.

- Offer Multiple Payment Options: Provide various payment methods to make paying easier for clients.

Inconsistent Invoice Numbers

Issue: Invoice numbers are not sequential or have duplicates, which is confusing. Troubleshooting:

- Automate Numbering: Use invoicing tools that automatically generate and track invoice numbers sequentially.

- Manual Adjustments: If manual numbering is used, carefully manage and track each number to avoid duplicates.

Currency and Tax Calculation Errors

Issue: Incorrect currency conversions or tax calculations. Troubleshooting:

- Verify Settings: Ensure the invoicing tool is set to handle the correct currency and tax rates.

- Regular Updates: Keep tax rates and currency conversion rates updated within the invoicing system.

- Use Accurate Tools: Utilize invoicing tools that integrate with reliable tax and currency databases.

Customization Issues

Issue: Difficulty customizing invoice templates to match your branding or specific needs. Troubleshooting:

- Explore Options: Check if your invoicing tool offers template customization options or pre-designed templates.

- Seek Support: Consult the tool’s support resources or customer service for assistance with template customization.

- Consider Upgrades: If customization options are limited, consider upgrading to a tool with more advanced features.

Integration Problems

Issue: Issues integrating the invoicing tool with other systems like accounting software or Shopify. Troubleshooting:

- Check Compatibility: Ensure the invoicing tool is compatible with your other systems.

- Review Integration Settings: Verify that integration settings and credentials are correctly configured.

- Consult Support: Reach out to the tool’s customer support for help with integration issues.

Security Concerns

Issue: Concerns about the security of sensitive financial data. Troubleshooting:

- Use Secure Tools: Choose invoicing tools that comply with security standards and offer encryption for data protection.

- Regular Updates: Keep your invoicing software updated with the latest security patches.

- Access Control: Implement strong access controls and authentication methods for users accessing invoicing data.

Invoicing Tool Not Performing as Expected

Issue: The invoicing tool is not working correctly or has performance issues. Troubleshooting:

- Restart and Update: Restart the tool and check for updates to resolve any temporary performance issues.

- Check System Requirements: Ensure that your system meets the tool’s requirements for optimal performance.

- Contact Support: Reach out to the tool’s support team for troubleshooting and assistance with persistent issues.

Customer Disputes

Issue: Customers dispute the invoice details, leading to payment delays. Troubleshooting:

- Provide Clear Documentation: Ensure invoices are detailed and precise to minimize disputes.

- Communicate Effectively: Address customer concerns promptly and provide explanations or corrections as needed.

- Review Policies: Have clear invoicing policies and procedures for resolving issues.

By addressing these common invoicing issues and implementing effective troubleshooting strategies, you can improve your invoicing process and maintain better financial management.

Related posts:

- 14+ Best Ad Spy Tools FREE

- 11 Best FREE Shopify Privacy Policy Generators

- 9 Best Walmart Product Research Tools